Where Growth Decisions Really Go Wrong (and How to Fix Them)

The new store looked perfect on paper – above-average household income, plenty of footfall, prime spot near a transport hub. Six months later, performance is flat, marketing spend feels like a black hole, and the board wants answers. The missing link? Most growth decisions still underplay one strategic layer of context, where you connect the dots between people, place and performance.

Location Intelligence changes that by turning your scattered data into an intuitive map of what drives results, where demand genuinely exists and how to scale the choices that work.

The five steps below aren’t a rigid framework, they’re a way of moving from assumptions to precise decisions. But it’s not just about site selection, as it affects territory rollout, investment and stakeholder buy-in. It’s also key to your marketing strategy, as 81% of retailers say location data has been ‘very important’ in improving their marketing results.

Step 1: Evaluate – From Numbers to Narrative

Most teams can see what is happening in their network from sales dashboards, POS reports and marketing metrics. The real question is why one store thrives while another, in a seemingly similar town, never quite takes off.

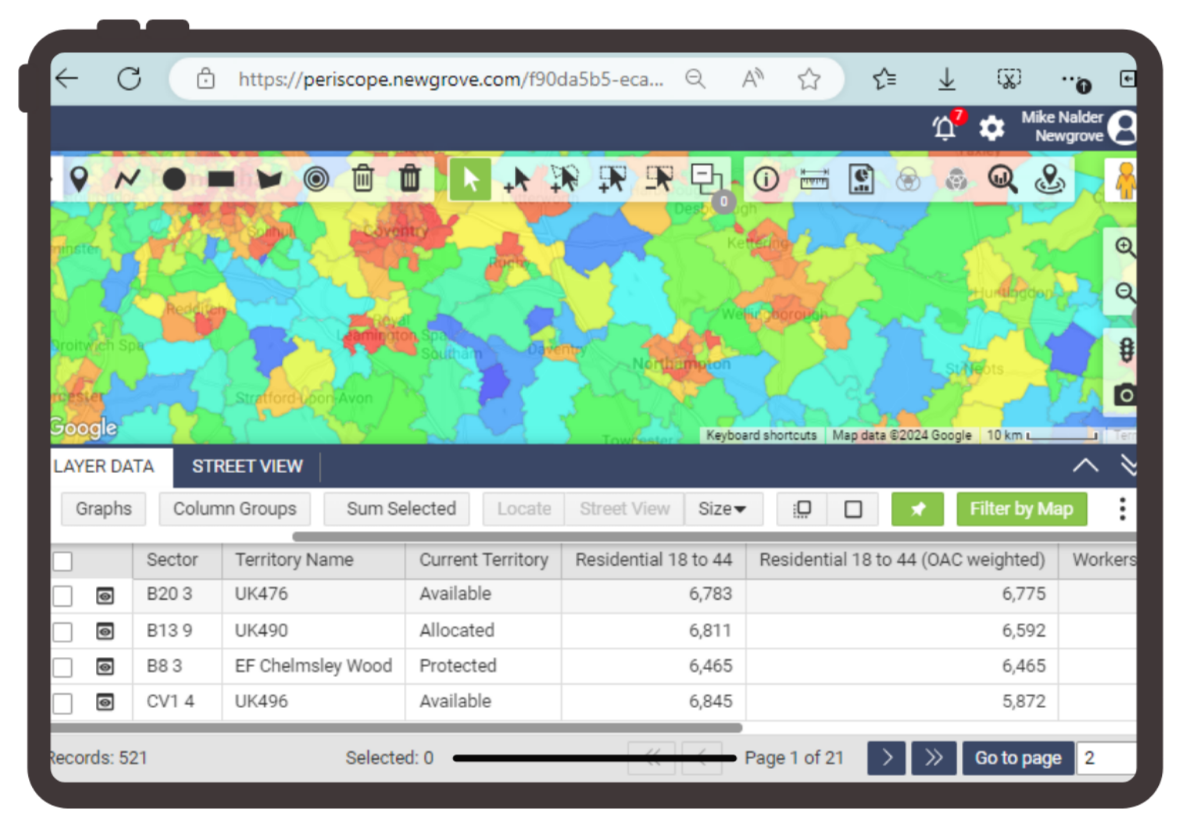

Evaluation turns disconnected performance data into a clear narrative of each location’s context, the mix of footfall, demographics and competition that sits behind the topline numbers. Using Periscope®, our powerful Location Intelligence software, you can visualise branches, catchments and competitors into a single map, so teams can see which locations over or underperform when those local factors are taken into account.

Step 2: Analyse – Uncover the Patterns Behind Performance

Once you know which of your sites are stronger, the next challenge is to understand what they have in common. This is where analysis shifts from “we think” to “the data shows”, revealing the patterns in behaviour, demographic change and local conditions that separate success from stagnation.

Best in class retailers are achieving success rates as high as 99.8% for new store openings when they use Location Intelligence to guide expansion decisions. They do this by layering internal performance with external data – footfall trends, catchment behaviour, competitor density and demographic shifts – Periscope® highlights the traits shared by your best locations and where they are replicated elsewhere.

This analysis transforms location data from static maps into actionable models you can test, refine and use to forecast potential for new sites.

Step 3: Target – Focus Where Demand Really Exists

Armed with clear patterns, the risk now is to spread investment too thinly, chasing any area that looks vaguely similar. Targeting is about discipline by concentrating resources on the locations and audiences most likely to deliver a sustainable return.

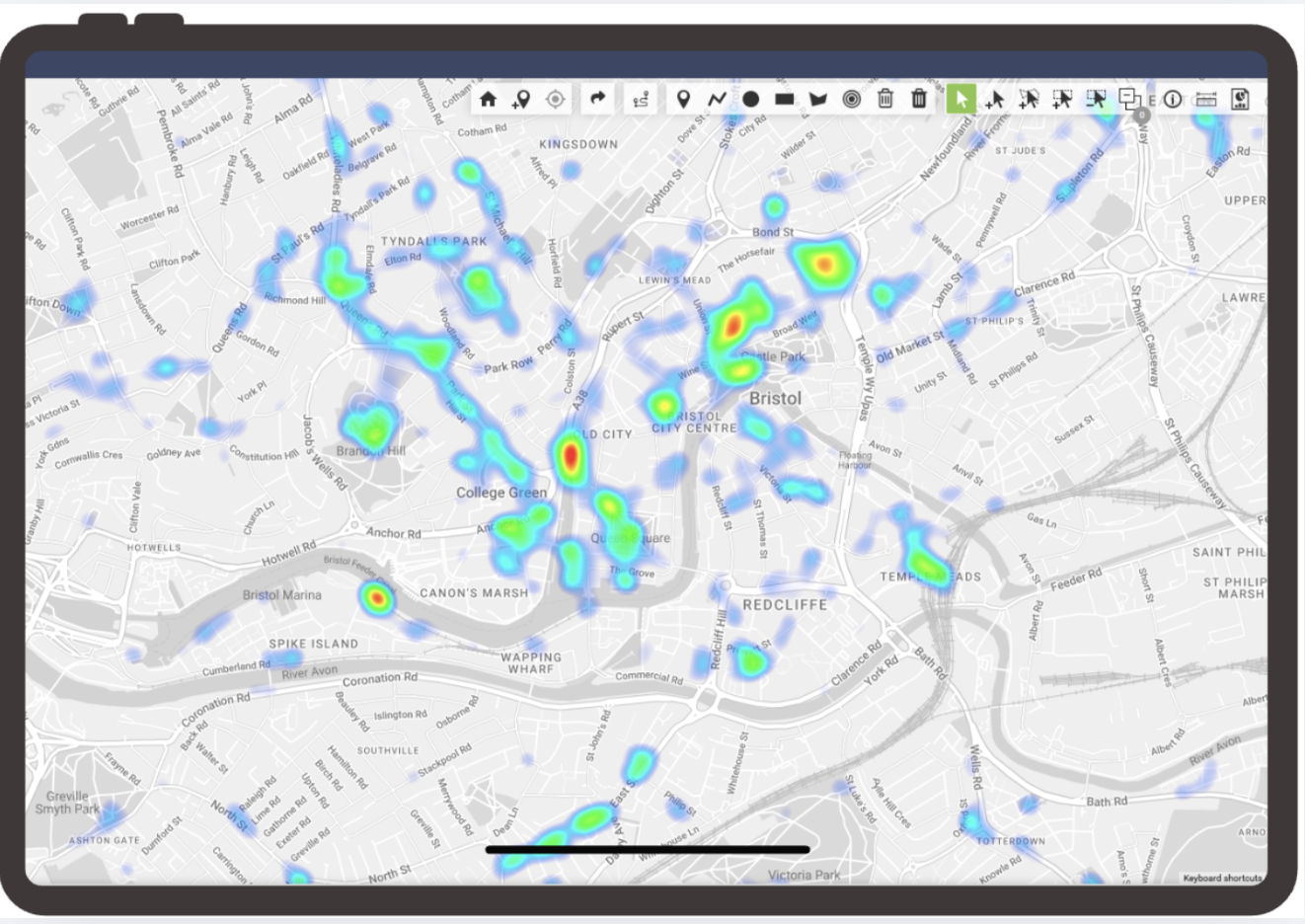

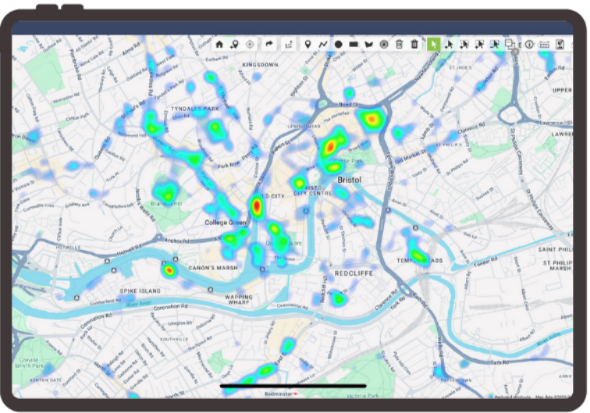

Instead of broad radii around a postcode, Location Intelligence refines catchments based on how people actually live, shop and commute, revealing high intent areas and whitespace markets that match your strongest performers.

With that focus, teams can confidently prioritise a shortlist of locations where customer profiles, local traffic patterns and competitive conditions all support growth, not just short-term sales spikes.

Step 4: Plan – Turn Insight into a Route to Market

Even with a clear target list, growth can stall if there is no structured way of turning insight into a practical route forward. Planning takes those high potential locations and stress tests them by modelling different scenarios, sequencing openings and aligning operational capacity with commercial ambition.

Location data-driven site selection can help retailers achieve up to a 10x ROI in retail operations. And when this planning is combined with AI driven predictive analytics, it turns what used to be educated guesswork into a measurable commercial advantage.

Location Intelligence supports this by enabling “what if” questions i.e. how performance changes with different store formats, opening dates or marketing intensity, and how new sites might cannibalise or complement existing ones. Structured planning means expansion stops being a series of one-off bets and becomes a repeatable playbook you can run every year.

Step 5: Scale – Make Growth Measurable and Repeatable

The final step is to embed this approach, so growth is not driven by one champion site or one big marketing project but becomes the default way decisions are made across the organisation. Scaling is about governance and culture as much as analytics.

When Location Intelligence sits at the centre of your growth, teams can continually evaluate performance, refresh analysis with new data, retarget investment and update plans as markets shift.

The result is a feedback loop where each new site, campaign or territory makes the models smarter, so the next wave of growth is even more predictable, more efficient — and more successful.

From Brave Moves to Precise Growth

The organisations that will win the next phase of expansion won’t be the boldest, they’ll be the ones who know exactly where their decisions will make the biggest impact.

Location Intelligence applied through these five steps, provides leaders with a way to test instinct against evidence, reduce wasted spend and grow with confidence into new locations, towns and territories.

Ready to put your growth strategy on the map? Let’s talk.